Provident Bank Offers a 10 Years Cd That Earns 215 Compunded Continuously

Provident Bank offers a 7-year CS that earns 1.77% compounded daily. If $7,000 is invested in this CD, how long will it take for the account to be worth $10,000?

Related Question

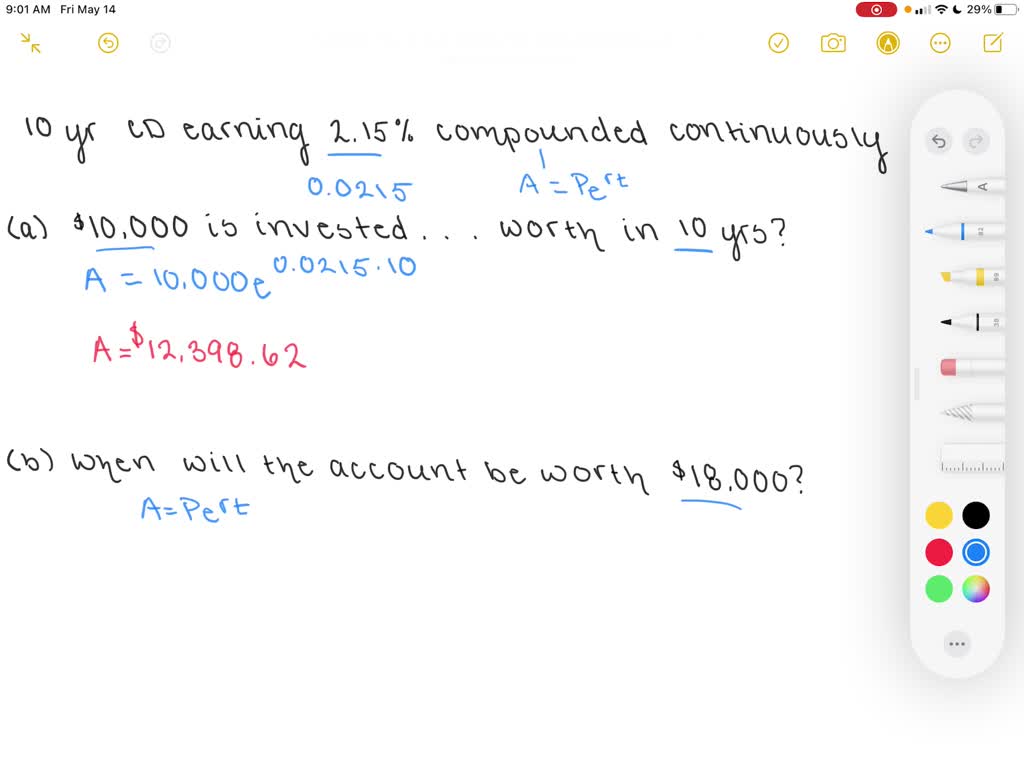

Provident Bank offers a 10-year CD that earns $2.15 \%$ compounded continuously. (A) If $\$ 10,000$ is invested in this $\mathrm{CD},$ how much will it be worth in 10 years? (B) How long will it take for the account to be worth $\$ 18,000 ?$

Discussion

You must be signed in to discuss.

Video Transcript

here were given the information that we've got a 10 year Cd which is earning 2.15% compounded continuously. And for part A. We're supposing that $10,000 is invested into this account and we want to know what it will be worth in 10 years. So to start for this compounded continuously, we're going to be using the corresponding formula where A. Is equal to P E. R. T. So we want to know for this part A. We're trying to find A. So this is the amount in that account when we have a principle of $10,000 times E. Time to the power of our rate which is 2.15% or in decimal form 0.215 times T. Which is our time. Which we were just given to be 10 years. So really all you need to do for this piece here is plug it into your calculator now and we can see that the account or a will be worth $12,398.62. And for part B. Here we want to know when will the account be worth $18,000? So let's I'm assuming we're continuing to assume that this $10,000 was invested into the account. So we're going to again be using our A. Is equal to P. E. R. T. Formula and A. Is that amount in the account right? Or the worth of it? So that's $18,000 which was just given to us is equal to our principle of $10,000 times E. To our rate which has remained the same at 0.215 and T. Is what we're trying to find. We want to know how long it will take for this account to be worth that amount. So we can go ahead and start to simplify. Let's divide both sides by 10,000. That will give us 1.8 is equal to E. To the power of 0.215 times T. And now we're looking at this in exponential form but we need to get rid of this exponents so that we can actually solve for T. So let's transfer this into log arrhythmic form by taking the natural log of both sides. So we'll have Ln times 1.8 that allows us to get rid of this E. And pull down our exponents. And now we can see pretty clearly we just need to divide both sides by our interest rate of 0.215 And that will be equal to T. So you can just plug that into your calculator then and we can see that T. Is equal to about 27 years just over. Um So it looks like it would take about 27 years for this account to be worth $18,000 if 10,000 was initially invested. Uh It seems just a little problematic given the fact that we're working with only a 10 year Cd. But mathematically, this is what it tells us. It would take 27 years for the account to be worth $18,000.

Source: https://www.numerade.com/ask/question/provident-bank-offers-a-7-year-cs-that-earns-177-compounded-daily-if-7000-is-invested-in-this-cd-how-long-will-it-take-for-the-account-to-be-worth-10000-61726/

0 Response to "Provident Bank Offers a 10 Years Cd That Earns 215 Compunded Continuously"

Post a Comment